By Catharine Proctor April 28, 2025

In today’s digital age, online transactions have become an integral part of our lives. Whether it’s purchasing goods or services, making donations, or subscribing to online platforms, the need for secure and efficient payment processing is paramount. This is where payment gateways come into play. A payment gateway is a technology that facilitates the transfer of funds between a customer and a merchant, ensuring a seamless and secure transaction.

In this comprehensive guide, we will delve into the intricacies of payment gateways, exploring their role in online transactions, their security measures, the different types available, and how to set up a payment gateway for your business.

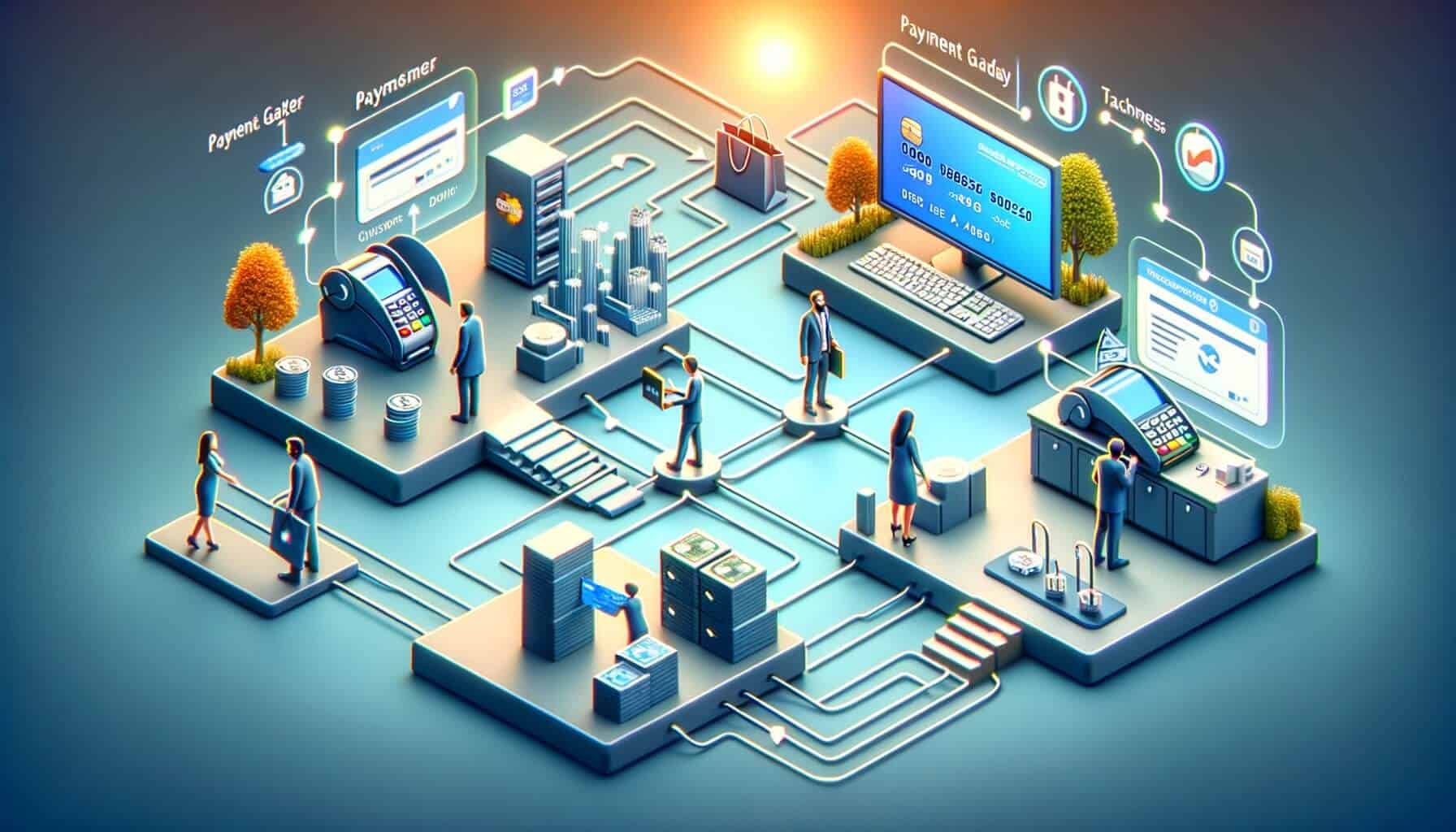

Understanding the Role of Payment Gateways in Online Transactions

Payment gateways act as a bridge between the customer, the merchant, and the financial institutions involved in the transaction. When a customer initiates an online payment, the payment gateway securely collects the customer’s payment information, encrypts it, and sends it to the acquiring bank or payment processor for authorization. Once the payment is authorized, the payment gateway communicates the approval or decline status back to the merchant and the customer, completing the transaction.

One of the primary functions of a payment gateway is to ensure the security of sensitive customer data during the transaction process. By utilizing encryption and tokenization techniques, payment gateways protect customer information such as credit card numbers, addresses, and personal details from unauthorized access. This layer of security is crucial in building trust between customers and merchants, as it safeguards against potential data breaches and fraud.

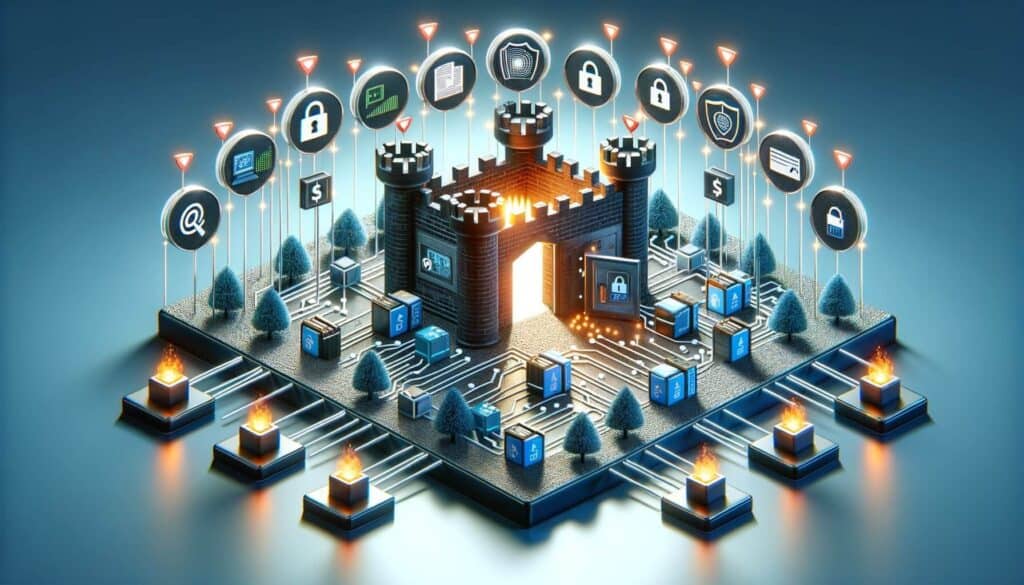

How Payment Gateways Secure Sensitive Customer Data

Payment gateways employ various security measures to protect sensitive customer data. One of the most common methods is encryption, which involves converting the customer’s payment information into an unreadable format during transmission. This ensures that even if the data is intercepted, it cannot be deciphered without the encryption key.

Additionally, payment gateways often utilize tokenization, a process that replaces sensitive data with unique identification symbols called tokens. These tokens are meaningless to anyone who does not have access to the tokenization system, providing an extra layer of security. In the event of a data breach, the stolen tokens would be useless to the attacker.

Furthermore, payment gateways comply with industry standards and regulations such as the Payment Card Industry Data Security Standard (PCI DSS). This set of security requirements ensures that merchants and payment gateways adhere to strict guidelines in handling and storing customer payment information. By complying with these standards, payment gateways demonstrate their commitment to maintaining the highest level of security for their customers.

Exploring the Different Types of Payment Gateways Available

There are several types of payment gateways available, each catering to different business needs and preferences. Let’s explore some of the most common types:

1. Hosted Payment Gateways: Hosted payment gateways redirect customers to a secure payment page hosted by the gateway provider. This type of gateway is easy to set up and requires minimal technical knowledge. However, it may redirect customers away from the merchant’s website, potentially impacting the user experience.

2. Self-Hosted Payment Gateways: Self-hosted payment gateways allow merchants to host the payment page on their own website, providing a seamless user experience. While this type of gateway offers more control, it requires technical expertise to set up and maintain.

3. API-Integrated Payment Gateways: API-integrated payment gateways allow for a more customized and integrated payment experience. Merchants can embed the payment form directly into their website, providing a seamless checkout process. This type of gateway requires technical knowledge to integrate but offers greater flexibility and control.

4. Mobile Payment Gateways: With the rise of mobile commerce, mobile payment gateways have gained popularity. These gateways are specifically designed for mobile devices, offering a user-friendly interface and optimized checkout experience on smartphones and tablets.

Step-by-Step Guide: How to Set Up a Payment Gateway for Your Business

Setting up a payment gateway for your business may seem daunting, but with the right guidance, it can be a straightforward process. Here is a step-by-step guide to help you get started:

1. Determine your business requirements: Before choosing a payment gateway, assess your business needs. Consider factors such as transaction volume, accepted payment methods, and integration options.

2. Research payment gateway providers: Conduct thorough research to identify reputable payment gateway providers that align with your business requirements. Consider factors such as pricing, security features, customer support, and compatibility with your e-commerce platform.

3. Apply for a merchant account: In most cases, you will need to apply for a merchant account with a financial institution or payment processor. This account will enable you to accept credit card payments and transfer funds to your business bank account.

4. Complete the application process: Once you have chosen a payment gateway provider and obtained a merchant account, complete the application process. This typically involves providing business information, verifying your identity, and agreeing to the terms and conditions.

5. Integrate the payment gateway: Depending on the type of payment gateway you have chosen, integration methods may vary. Follow the provider’s instructions to integrate the payment gateway into your website or e-commerce platform. This may involve installing plugins, adding code snippets, or utilizing APIs.

6. Test the payment gateway: Before going live, thoroughly test the payment gateway to ensure it functions correctly. Make test transactions using different payment methods to verify that the funds are processed and received successfully.

7. Go live and monitor transactions: Once you are confident in the functionality of your payment gateway, make it live on your website. Monitor transactions regularly to ensure smooth processing and address any issues promptly.

Key Features and Benefits of Payment Gateways for Merchants

Payment gateways offer numerous features and benefits for merchants. Let’s explore some of the key advantages:

1. Increased sales and conversion rates: By providing a seamless and secure payment experience, payment gateways can boost sales and conversion rates. Customers are more likely to complete a purchase if they trust the payment process and feel confident in the security measures in place.

2. Global reach: Payment gateways enable merchants to accept payments from customers worldwide, expanding their customer base and market reach. With support for multiple currencies and payment methods, merchants can cater to diverse customer preferences.

3. Fraud prevention: Payment gateways employ advanced fraud detection and prevention tools to minimize the risk of fraudulent transactions. These tools analyze transaction patterns, identify suspicious activities, and provide real-time alerts, allowing merchants to take appropriate action.

4. Streamlined checkout process: A smooth and user-friendly checkout process is crucial for customer satisfaction. Payment gateways offer features such as one-click payments, saved card details, and guest checkout options, reducing friction and enhancing the overall shopping experience.

5. Reporting and analytics: Payment gateways provide merchants with detailed reporting and analytics, offering insights into transaction volumes, revenue, and customer behavior. This data can be used to make informed business decisions, optimize marketing strategies, and identify areas for improvement.

Common Challenges and Solutions in Payment Gateway Integration

While integrating a payment gateway into your business may seem straightforward, there can be challenges along the way. Here are some common challenges and their solutions:

1. Technical complexity: Integrating a payment gateway may require technical expertise, especially for API-integrated gateways. To overcome this challenge, consider hiring a developer or utilizing resources provided by the payment gateway provider, such as documentation and support forums.

2. Compatibility issues: Ensure that the payment gateway you choose is compatible with your e-commerce platform or website. Some gateways offer plugins or extensions specifically designed for popular platforms, simplifying the integration process.

3. Security concerns: Security is a top priority when it comes to payment gateways. To address security concerns, choose a payment gateway provider that is PCI DSS compliant and utilizes encryption and tokenization techniques to protect customer data.

4. Payment method support: Different payment gateways support different payment methods. Ensure that the gateway you choose supports the payment methods preferred by your target audience. Consider factors such as credit cards, digital wallets, bank transfers, and alternative payment methods.

Factors to Consider When Choosing the Right Payment Gateway for Your Business

Choosing the right payment gateway for your business is crucial for a smooth and secure payment process. Here are some factors to consider:

1. Security: Ensure that the payment gateway provider prioritizes security and complies with industry standards such as PCI DSS. Look for features such as encryption, tokenization, and fraud prevention tools.

2. Integration options: Consider the integration options available for the payment gateway. Choose a gateway that seamlessly integrates with your e-commerce platform or website, minimizing technical complexities.

3. Pricing and fees: Evaluate the pricing structure and fees associated with the payment gateway. Consider factors such as setup fees, transaction fees, monthly fees, and any additional charges for specific features or services.

4. Customer support: Reliable customer support is essential when it comes to payment gateways. Look for providers that offer 24/7 support, multiple contact channels, and prompt response times to address any issues or concerns.

5. Reputation and reviews: Research the reputation and reviews of the payment gateway provider. Look for testimonials from other merchants to gauge their satisfaction with the service, reliability, and overall experience.

Frequently Asked Questions (FAQs) about Payment Gateways

Q1. What is a payment gateway?

Answer: A payment gateway is a technology that facilitates the transfer of funds between a customer and a merchant during an online transaction. It securely collects and encrypts the customer’s payment information, sends it for authorization, and communicates the approval or decline status back to the merchant and customer.

Q2. How do payment gateways secure sensitive customer data?

Answer: Payment gateways secure sensitive customer data through encryption and tokenization techniques. Encryption converts the data into an unreadable format during transmission, while tokenization replaces sensitive data with unique identification symbols. Additionally, payment gateways comply with industry standards such as PCI DSS to ensure the highest level of security.

Q3. What types of payment gateways are available?

Answer: There are several types of payment gateways available, including hosted payment gateways, self-hosted payment gateways, API-integrated payment gateways, and mobile payment gateways. Each type offers different features and integration options to cater to various business needs.

Q4. How do I set up a payment gateway for my business?

Answer: To set up a payment gateway for your business, you need to determine your requirements, research payment gateway providers, apply for a merchant account, complete the application process, integrate the payment gateway into your website or e-commerce platform, test its functionality, and then go live.

Q5. What are the benefits of using a payment gateway for merchants?

Answer: Payment gateways offer benefits such as increased sales and conversion rates, global reach, fraud prevention tools, a streamlined checkout process, and reporting and analytics capabilities. These advantages contribute to a seamless and secure payment experience for both merchants and customers.

Conclusion

Payment gateways play a vital role in facilitating secure and efficient online transactions. By securely collecting and transmitting customer payment information, payment gateways ensure a seamless transfer of funds between customers and merchants. With advanced security measures such as encryption and tokenization, payment gateways protect sensitive customer data from unauthorized access.

There are various types of payment gateways available, each offering different features and integration options. Setting up a payment gateway for your business requires careful consideration of factors such as security, integration, pricing, and customer support. By choosing the right payment gateway and overcoming common challenges, merchants can provide a seamless and secure payment experience, ultimately boosting sales and customer satisfaction.