By Catharine Proctor January 29, 2025

In today’s fast-paced world, convenience and efficiency are key factors in running a successful business. One aspect that plays a crucial role in achieving these goals is the ability to accept credit card payments. Portable credit card terminals have revolutionized the way businesses process transactions, providing a convenient and secure method for accepting payments on the go.

In this comprehensive guide, we will explore everything you need to know about portable credit card terminals, from how they work to the benefits they offer, and the factors to consider when choosing one.

How Portable Credit Card Terminals Work

Portable credit card terminals, also known as mobile card readers, are compact devices that allow businesses to accept credit and debit card payments wirelessly. These terminals utilize wireless technology, such as Bluetooth or Wi-Fi, to connect to a smartphone or tablet, enabling businesses to process transactions anywhere, anytime. The terminal acts as a bridge between the customer’s card and the payment processor, securely transmitting the payment information for authorization and settlement.

To use a portable credit card terminal, businesses need to download a compatible mobile app on their smartphone or tablet. The app acts as the interface for processing payments, allowing businesses to enter the transaction amount, select the payment method, and capture the customer’s card information. Once the transaction details are entered, the terminal securely encrypts the data and sends it to the payment processor for authorization. Upon receiving the authorization, the terminal completes the transaction, providing a seamless and efficient payment experience.

Benefits of Using Portable Credit Card Terminals

The adoption of portable credit card terminals has numerous benefits for businesses of all sizes. Let’s explore some of the key advantages they offer:

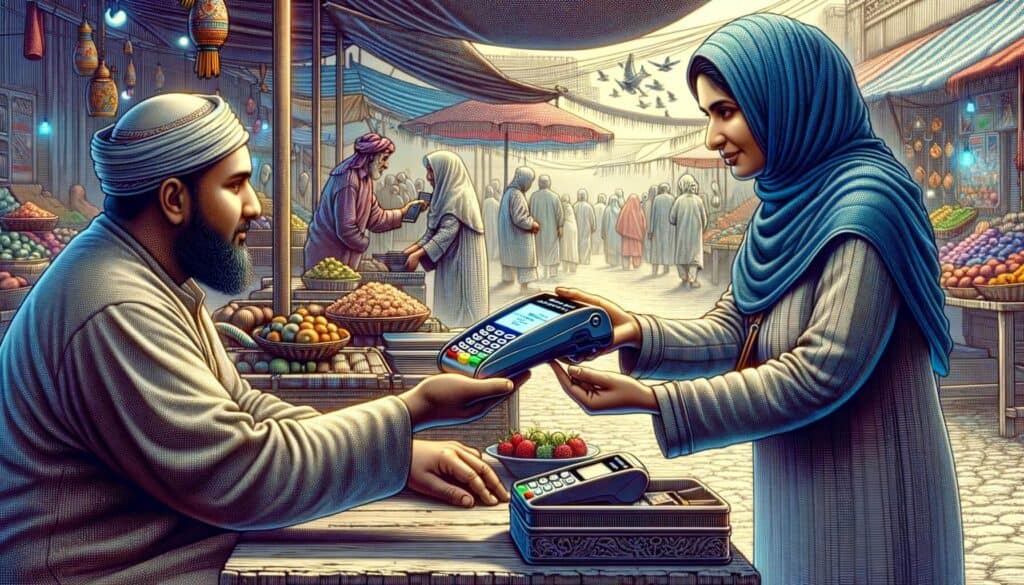

1. Increased Sales Opportunities: By accepting credit card payments on the go, businesses can expand their customer base and capture sales opportunities that would otherwise be missed. Whether it’s a pop-up shop, a food truck, or a service-based business, portable credit card terminals enable businesses to accept payments wherever their customers are.

2. Convenience and Flexibility: Portable credit card terminals provide businesses with the flexibility to accept payments anytime, anywhere. Whether it’s at a trade show, a customer’s location, or even outdoors, these terminals eliminate the need for a fixed point-of-sale system, allowing businesses to serve their customers with ease and convenience.

3. Faster Checkout Process: With portable credit card terminals, businesses can significantly reduce the time spent on processing transactions. Instead of manually entering card details or dealing with cash, customers can simply swipe or insert their cards into the terminal, making the checkout process quick and efficient.

4. Enhanced Security: Portable credit card terminals employ advanced encryption and tokenization technologies to ensure the security of customer payment information. These terminals are designed to meet the highest security standards, protecting businesses and their customers from potential data breaches and fraud.

5. Improved Cash Flow: By accepting credit card payments, businesses can enjoy faster access to funds. Unlike traditional methods where checks need to be deposited or cash needs to be counted, portable credit card terminals enable businesses to receive payments directly into their bank accounts, reducing the time and effort involved in managing cash flow.

Factors to Consider When Choosing a Portable Credit Card Terminal

When selecting a credit card terminal for your business, it’s essential to consider several factors to ensure you choose the right device that meets your specific needs. Here are some key factors to consider:

1. Compatibility: Ensure that the portable credit card terminal you choose is compatible with your smartphone or tablet. Check if the terminal supports both iOS and Android devices, as this will allow you to cater to a wider range of customers.

2. Connectivity Options: Consider the connectivity options offered by the terminal. Bluetooth and Wi-Fi are the most common options, but some terminals also offer cellular connectivity, which can be useful in areas with limited Wi-Fi coverage.

3. Payment Methods: Check if the terminal supports a wide range of payment methods, including chip cards, contactless payments (such as Apple Pay and Google Pay), and traditional magnetic stripe cards. Offering multiple payment options will ensure you can cater to the preferences of all your customers.

4. Transaction Fees: Compare the transaction fees charged by different portable credit card terminals. While some terminals offer competitive rates, others may have higher fees or additional charges for certain features. Consider your business volume and transaction frequency to choose a terminal that offers the most cost-effective solution.

5. Battery Life: Since portable credit card terminals rely on battery power, it’s crucial to consider the battery life of the device. Look for terminals that offer long-lasting battery performance to ensure uninterrupted operation throughout the day.

Setting Up and Activating Your Portable Credit Card Terminal

Once you have chosen the right portable credit card terminal for your business, the next step is to set it up and activate it. Here’s a step-by-step guide to help you get started:

1. Unbox the Terminal: Carefully unbox the portable credit card terminal and ensure that all the components are included. This typically includes the terminal itself, charging cables, and any additional accessories.

2. Charge the Terminal: Before using the terminal, make sure it is fully charged. Connect the charging cable to the terminal and plug it into a power source. Allow the terminal to charge until the battery is full.

3. Download the Mobile App: Visit the app store on your smartphone or tablet and search for the mobile app associated with your portable credit card terminal. Download and install the app on your device.

4. Create an Account: Open the mobile app and follow the on-screen instructions to create an account. This usually involves providing your business information, contact details, and bank account information for funds settlement.

5. Pair the Terminal: Once your account is set up, follow the app’s instructions to pair the portable credit card terminal with your smartphone or tablet. This typically involves enabling Bluetooth or Wi-Fi on your device and selecting the terminal from the available devices list.

6. Test the Connection: After pairing the terminal, perform a test transaction to ensure that the connection between the terminal and the app is working correctly. Enter a small transaction amount and complete the payment process to verify that the terminal is functioning as expected.

Accepting Payments with a Portable Credit Card Terminal

Now that your portable credit card terminal is set up and activated, you are ready to start accepting payments. Here’s a guide on how to accept payments using a portable credit card terminal:

1. Enter the Transaction Amount: Open the mobile app on your smartphone or tablet and enter the transaction amount. Ensure that the amount is accurate and matches the customer’s purchase.

2. Select the Payment Method: Ask the customer to present their card for payment. Depending on the type of card they have, instruct them to either swipe, insert, or tap their card on the terminal. If the customer prefers a contactless payment method, ensure that the terminal is set to accept such payments.

3. Capture Card Information: Once the customer has initiated the payment process, the terminal will prompt them to enter their PIN or sign the screen, depending on the card type and payment method. Instruct the customer to follow the on-screen instructions and complete the necessary steps.

4. Process the Transaction: After the customer has completed the necessary steps, the terminal will securely transmit the payment information to the payment processor for authorization. The processor will verify the card details and check for available funds before sending an authorization response back to the terminal.

5. Obtain Customer Confirmation: Once the transaction is authorized, the terminal will display a confirmation message on the screen. Show the confirmation message to the customer and ask them to verify the details. If everything is correct, ask the customer if they would like a receipt.

6. Provide a Receipt: Depending on your business setup, you can provide a printed receipt or send an electronic receipt to the customer’s email address or phone number. Ensure that the receipt includes all the necessary details, such as the transaction amount, date, and merchant information.

Security Measures and Fraud Prevention with Portable Credit Card Terminals

Security is a top priority when it comes to processing credit card payments. Portable credit card terminals employ various security measures and fraud prevention techniques to ensure the safety of customer payment information. Here are some key security features to look for in a portable credit card terminal:

1. Encryption: Portable credit card terminals use encryption technology to protect sensitive cardholder data during transmission. Look for terminals that support end-to-end encryption, which ensures that the data is securely encrypted from the moment it is captured until it reaches the payment processor.

2. Tokenization: Tokenization is a technique that replaces sensitive card data with a unique identifier called a token. This token is used for transaction processing, while the actual card data is securely stored in a token vault. Tokenization adds an extra layer of security by ensuring that even if the token is intercepted, it cannot be used to retrieve the original card data.

3. EMV Compliance: EMV (Europay, Mastercard, and Visa) is a global standard for chip card payments. Portable credit card terminals should be EMV compliant, meaning they can process chip card transactions securely. EMV technology reduces the risk of counterfeit card fraud by generating a unique transaction code for each payment, making it difficult for fraudsters to replicate the card information.

4. PCI DSS Compliance: The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to protect cardholder data. Ensure that the portable credit card terminal you choose is PCI DSS compliant, meaning it meets the industry’s security requirements and undergoes regular security audits.

5. Fraud Prevention Tools: Look for portable credit card terminals that offer additional fraud prevention tools, such as address verification service (AVS) and card verification value (CVV) checks. These tools help businesses verify the authenticity of the card and reduce the risk of fraudulent transactions.

Troubleshooting Common Issues with Portable Credit Card Terminals

While portable credit card terminals are designed to be user-friendly and reliable, occasional issues may arise. Here are some common problems you may encounter with portable credit card terminals and how to troubleshoot them:

1. Connection Issues: If you are experiencing connection issues between the terminal and your smartphone or tablet, ensure that Bluetooth or Wi-Fi is enabled on both devices. Make sure that the terminal is within range of your device and that there are no obstructions interfering with the signal. If the problem persists, try restarting both devices and re-pairing them.

2. Battery Drain: If your portable credit card terminal’s battery is draining quickly, check if any power-hungry apps or features are running in the background. Close unnecessary apps and disable any features that are not required during the transaction process. If the battery drain continues to be an issue, consider carrying a portable charger or spare batteries to ensure uninterrupted operation.

3. Card Reading Errors: If the terminal is having trouble reading the customer’s card, ensure that the card is inserted or swiped correctly. Check for any dirt or debris on the card reader and clean it if necessary. If the problem persists, try using a different card or ask the customer to try a different payment method.

4. Slow Transaction Processing: If transactions are taking longer than usual to process, check your internet connection speed. Slow internet speeds can affect the terminal’s ability to communicate with the payment processor. If possible, switch to a more reliable network or move to an area with better signal strength.

5. Software Updates: Regularly check for software updates for both the mobile app and the portable credit card terminal. Software updates often include bug fixes, security enhancements, and new features that can improve the performance and reliability of the terminal.

Frequently Asked Questions about Portable Credit Card Terminals

Q1. Are portable credit card terminals secure?

Yes, portable credit card terminals are designed with security in mind. They employ encryption, tokenization, and other security measures to protect customer payment information. However, it’s essential to choose a terminal that is PCI DSS compliant and follows industry best practices to ensure maximum security.

Q2. Can I accept contactless payments with a portable credit card terminal?

Yes, most portable credit card terminals support contactless payments, such as Apple Pay and Google Pay. Ensure that the terminal you choose has the necessary hardware and software capabilities to accept contactless payments.

Q3. How long does it take to receive funds from credit card transactions?

The time it takes to receive funds from credit card transactions can vary depending on the payment processor and your bank. In general, funds are typically deposited into your bank account within 1-2 business days.

Q4. Can I use a portable credit card terminal without an internet connection?

Some portable credit card terminals offer offline mode, allowing you to accept payments even without an internet connection. However, offline transactions may have limitations, such as a maximum transaction amount or the need to manually upload the transactions once you regain internet connectivity.

Q5. Can I issue refunds using a portable credit card terminal?

Yes, most portable credit card terminals allow you to issue refunds directly from the mobile app. Simply locate the transaction in the app, select the refund option, and follow the on-screen instructions to process the refund.

Conclusion

Portable credit card terminals have revolutionized the way businesses accept payments, providing convenience, flexibility, and enhanced security. By understanding how these terminals work, the benefits they offer, and the factors to consider when choosing one, businesses can make informed decisions to meet their specific needs. Setting up and activating a portable credit card terminal is a straightforward process, and accepting payments is seamless and efficient.

With the right security measures in place and the ability to troubleshoot common issues, businesses can confidently embrace portable credit card terminals as a valuable tool in their payment processing arsenal. So, whether you’re a small business owner, a mobile vendor, or a service provider, consider investing in a portable credit card terminal to streamline your payment processes and enhance the overall customer experience.